Why has Quote-to-Cash (Q2C) Become Exceptionally Hard and Why are Salesforce, Zuora, and SAP after it?

The Next $10B Opportunity in Enterprise IT

Update (Jan 2021): This article was meant to be my CliffsNotes but it somehow ended up touching a nerve and a lot of you reached out and commented on it. I am now working on a solution to fix this using the first-principles approach as I have laid out here. I also started a podcast on Enterprise Monetization. Stay tuned for more.

(I want to sincerely thank all the folks — 100+ people — who spent time with me graciously to share their perspectives on Q2C. What makes it even more unique is that I didn’t know most of them beforehand and still they selflessly chose to spend time with me without expecting anything in return. This is truly heartwarming!)

I was talking to a Product Manager of a SaaS company a few months back and she mentioned that subscription billing was massively broken for them and hurting them badly on revenue growth. They were using two products — Salesforce CPQ and Zuora. The product manager lamented that these tools are not designed for SaaS and cause massive friction in revenue operations. With zero background in subscriptions (at that time), I wondered what could be so complex about a charge that is incurred on a periodic basis.

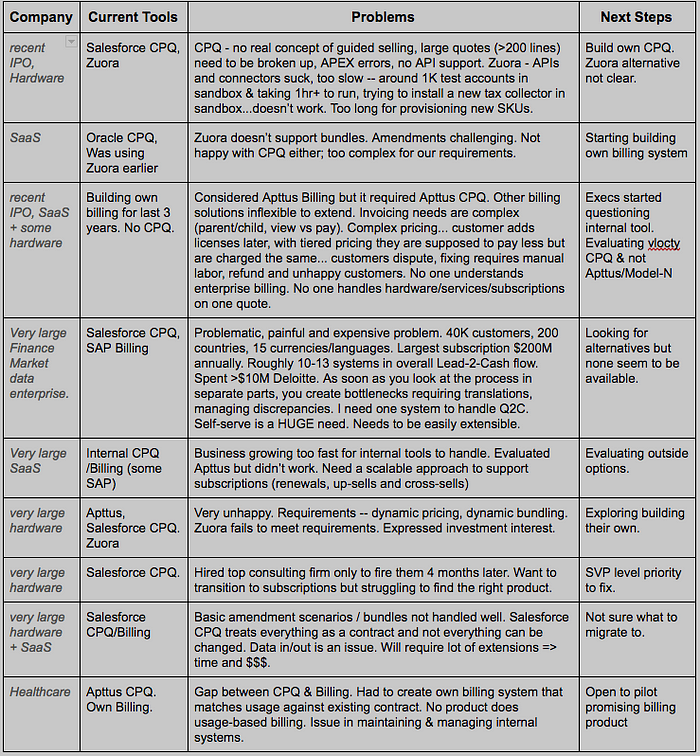

But then, I talked to several other tech companies (large public, recent IPO, hardware, SaaS) and interestingly all of them mentioned that their Quote-to-Cash (Q2C) had huge issues. I was told that one company spent as much as $300M (!!) in fixing Q2C and that too with less than satisfactory results.

If you are not familiar with Quote-to-cash terminology, it covers a set of steps starting from the generation of a Sales Quote and ending in receiving money from the customer and recording the transaction in the General Ledger (Accounting tool).

A related terminology is Opportunity-to-Cash — think of this as the superset of Quote-to-Cash terminology. Instead of the process starting from the Quoting tool, it starts a step before, i.e., in the CRM system where the intent to purchase is represented by an object called Opportunity (HubSpot CRM uses the term Deal instead).

Another related term is Lead-to-Cash which is the superset of Opportunity-to-Cash in that it captures the process starting yet another step before — when the customer is still a Lead (Marketing to).

Since Quote-to-cash is a mission-critical process for any company (it enables the company to earn revenue), I decided to dig deeper as to why has this become a big problem for everyone.

This article presents a summary/analysis and towards the end a proposal to solve the problem based on 100+ conversations with customers/system integrators over a period of 3 months.

First, a little bit more on the Quote-to-cash steps:

- The customer intends to purchase a product captured as an Opportunity/Deal in the CRM product.

- From there, a sales rep uses a tool called CPQ (Configure Price Quote) to configure the list of products/services the customer wants, then pricing it (this usually involves giving discounts or doing price increases for multi-year deals etc., ), and then finally generating a professional-looking (usually PDF) Quote. The sales rep can generate multiple quotes to reflect different pricing scenarios. For example, a 1-year deal could be one quote, and a 3-year deal could be another.

- Once the customer agrees to a particular Quote, the sales rep sends the Quote to the Customer for eSign, and finally, the Opportunity in the CRM is marked as closed. Usually, the signed PDF is uploaded to the CRM as well.

- At this stage, the second half of the Q2C process kicks in. When the Opportunity in the CRM is closed, an email notification is sent to a few teams — usually Ops and Billing teams.

- The job of the Ops team is to provision the system for the customer; they figure out what licenses, subscriptions, entitlements, etc., have to be turned on in the product to fulfill what is promised to the customer. This process is surprisingly predominantly still manual.

- The Billing team uses the signed PDF information and does a swivel-chair manual data transfer to the Billing system. This involves creating customer information in the Billing system, copying the discounts/pricing line-by-line, and generating an invoice from the Billing system. It is an error-prone and challenging job, and as you get more customers, the entire exercise becomes exceedingly more painful and adversely affects how quickly you can get paid by your customers.

- Finally, the customer receives the invoice and then pays the vendor either through a credit card or ACH (or whatever payment method is prevalent in that geo e.g., in Europe SEPA is prevalent).

- Depending on how the payment is set up, either the invoice is automatically marked as paid, or the billing person has to look at the bank statement and close the invoice manually by doing a reconciliation.

- Finally, the invoice data and status is passed to the downstream accounting system, which records the invoice amount in the correct ledger.

In the above workflow, I have not covered the redlining of contracts that is part of the enterprise Quote-to-cash workflow. This functionality is done by a tool known as CLM (Contract Lifecycle Management). If you are interested to know more, check this blog post on Quote-to-cash by Apttus (one of the leading CPQ vendors).

Enterprises across all industry verticals have the following urgent requirements:

- Transition to subscriptions and consumption-based business models,

- Ability to offer new bundles in hours & not weeks or months, and

- Enable self-serve (also called Product-led-growth or PLG).

Unfortunately, the existing Quote-to-cash tools have failed to meet the above requirements resulting in a broken revenue infrastructure. Here’s a quick summary of my findings on the pain points based on my conversations:

Summary of Problems

- Doing any sort of pricing or packaging changes takes months instead of a few hours — The primary reason for this delay is that the CPQ and Billing tools have different product catalogs and doing any pricing/packaging requires making painful changes in the product catalog which usually involves lengthy professional services implementation.

- Enabling the self-serve channel is massively painful — Existing tools were not designed for PLG so anything self-serve is a massive DIY effort.

- Reseller channel workflow is still manual — resellers send a request to quote to an employee (usually a channel sales manager) who then generates the Quote and sends it across to the reseller over email. Reseller invoicing is also manual. This is actually shocking considering a large amount of late stage enterprise business goes through the resellers.

- It is an excruciatingly painful manual process to move customers across different sales channels e.g., from self-serve to sales-led/CRM (also called Expansion), or moving from sales-led/CRM to self-serve (also called Contraction).

- Invoicing is surprisingly still manual and error-prone — Billing teams do swivel-chair data transfer between the CRM and the Billing System.

- Supporting Amendments is a painfully manual process even though amendments are the basic building blocks of the SaaS land-and-expand business model. Amendments happen when a customer asks for more (upsell) or less (downsell) or something different (cross-sell) during the contract. The challenge is that CPQ and Billing systems don’t share the concept of a sales “Contract” — which means that each amendment is treated as a new contract and all hell breaks loose as now what a customer owns is spread over multiple discrete un-connected contracts and at renewal, finding what to renew and at what prices becomes a treasure hunt.

- Proration challenges — Proration is the by-product of Amendments; this means that customer doesn’t pay the full price of the product as they are buying the product for a fraction of the period. For example, let’s say a subscription costs $120 per year per seat. The customer wants to buy an additional seat 3 months into the subscription. They will pay only $90 ($120/12 * 9). At a quick glance, proration seems logical and simple but it is quite circuitous — imagine the upsell happens in the middle of the month; for the remainder period do you prorate based on the number of days remaining or whole calendar months or partial months, etc., This is where Quoting and Billing systems go out of sync resulting in a mismatch between Quote and Invoice and a lot of unnecessary heartburn.

- Renewals are massively painful due to the fact that amendment data is spread across multiple disconnected deals. Furthermore, for low ACV deals, this should be a completely automated process (self-serve) instead of a manual process. However, this simply cannot be done with the existing tools.

- Almost everyone complained about no good system of truth for Contracts. Some CPQs don’t even have the concept and then Billing systems don’t understand it creating massive issues in not only managing SaaS business but also making revenue recognition unnecessarily a painful exercise.

- Outdated and incompatible product catalog across CRM/CPQ/Billing/Accounting systems leads to data duplication and a lot of complicated integration work across the stack (this is one of the reasons why the iPaaS solutions have gone popular in recent years)

- Because data is not clean, analytics and reporting become complex [garbage-in, garbage-out].

- Enabling usage-based billing is a massive challenge — traditional billing systems can’t handle real-time metering and the new standalone usage systems have a couple of big problems — first, they are not a replacement for your billing/invoicing solution as a billing system requires lots of features — credit/debit notes, invoice presentment, dunning, revenue recognition, payment processing, etc., which requires time. Consequently, almost all standalone usage systems require you to own a separate Billing system that will import usage metering data from the usage tool which becomes a painful exercise. Second, standalone usage tools have a different product catalog than the upstream CPQ or the downstream Billing system which means that massive integration work is required to connect all three systems.

- Existing billing systems have a hard time supporting the self-serve channel — Most enterprise billing systems can’t support the concept of free users or try-and-buy models.

- Broken APIs — existing tools were designed to be UI-heavy tools with little to no focus on API design. This becomes an issue when you have to support self-serve or consumption-based models.

- No good Sandbox support — imagine you are launching a new product/pricing package, you would like to be able to test the Quoting/Billing in a separate sandbox before configuring this in Production. Existing CPQ and Billing tools have poor sandbox support — it takes a lot of cost and time to create one. Ideally, one would want to instantly spin up a new sandbox in a self-serve fashion.

- No mobile-centric experience — doing approvals quickly, ability to see the renewal pipeline, customer life cycle; essentially ability to see the key data of your business quickly)

- Inherent lack of scalability in both CPQ and Billing solutions — if the Quote has more than a few offerings, CPQ slows down leading to sales rep frustration. Billing systems are also known to crack under pressure when thousands of invoices need to be generated towards the end of the month.

- Implementation of tools is massively painful — customers routinely spent thousands of dollars just on implementations. Furthermore, doing most pricing/ packaging changes required to call upon professional services. For every dollar being spent on the tools in the Quote-to-cash stack, customers are spending $3-$4 in connecting the tools.

Why has Quote-to-Cash become a complex problem & why has no one been able to fix it meaningfully?

Non-SaaS to SaaS transition

The biggest change in the last few years is the transition from selling one-time products to subscriptions and now consumption-based models. Let’s examine this in more detail.

The one-time selling motion of Non-SaaS had the following key characteristics:

- Each transaction was terminal i.e., no upgrades/downgrades in the future. If you need to buy more, you do another transaction.

- Information flow was one-way i.e., the rep generated the quote which was then used by the billing teams to generate an invoice. There was no feedback loop from the Billing to the CPQ system — it wasn’t needed.

- Transactions were low-volume and high-dollar — this was an artifact of the sales-led sales process

What that meant for the underlying CPQ and Billing systems was the following:

- Due to the Non-SaaS nature of the business, product pricing is SKU-based which means that a disparate product catalog between the CPQ and Billing system hardly matters.

- Furthermore, these systems need not be connected — since the deal volume is low, the quote can be manually converted to an invoice.

- CPQ systems were built for the sales reps and sold to the Head of Sales while Billing systems were built for the billing teams and sold to the Head of Finance. Everything was actually perfect.

Then came subscriptions and Usage and all the assumptions of the Non-SaaS world got turned on their head.

- First and foremost, the core thesis of subscriptions/SaaS is the land-and-expand motion i.e., you want the customer to buy more during the contract period. This means that no transaction is terminal! Instead, there is a life-cycle to it i.e., the customer buys some seats at the beginning of the contract period (land) and then you expect them to come back sometime during the contract period and buy more seats (expand). To support this workflow, the CPQ now needs to “remember” the previous transaction and carry forward the discounts or any changes in pricing (if let’s say pricing tiers involved). Imagine multiple such transactions happening during the contract period which would be upsell/downsell/cross-sell — all of these need to be remembered for the renewal. Existing CPQs were not designed around this concept.

- SaaS also enabled the self-serve channel which means now the transactions could be high-volume and low-dollar. This type of sales motion rules out having sales reps to do quoting — Not only it is not economically feasible (due to low dollar), it is not practically feasible (due to high volume). This implies that your CPQ and Billing infrastructure should support self-serve but classic tools were not built for that. Consequently, enterprises today are forced to build and manage two parallel Quote-to-cash workflows (one for direct sales and another for the self-serve channel).

- SaaS enables complex product packaging/pricing (e.g., Good/Better/Best plans with several add-ons) which wasn’t the case earlier This implies that the product catalog of the CPQ and Billing systems now needs to support the concept of time (i.e., subscriptions), bundling, and consumption-based business models. Traditional CPQ and Billing systems were designed to sell hardware/things, that had fixed units, and to support subscriptions of usage business models is essentially a re-write. Consequently, traditional vendors have fared poorly in supporting both subscriptions and usage.

- SaaS also unlocks the ability to make rapid pricing and packaging changes. This in turn means that new GTM models need to be quickly implemented in both the CPQ and the Billing systems. However, since the underlying product catalogs of the two systems are disparate, any small change in pricing turns into a massive effort.

SaaS also brought other related issues to the forefront.

- CRMs were designed for 1000s of accounts not millions of accounts/data points; consequently, even basic scaling/performance requirements are unmet. I was told that Salesforce CPQ cannot handle quotes of more than 200 lines so the quote needs to be divided into multiple quotes (Salesforce experts can recall dreaded “governor” limits. Now, any PaaS system will have checks and balances around resource consumption (e.g., here is Google App Engine’s) but it seems that the way it is done in Salesforce imposes basic restrictions e.g., one can only query 100 SQL records per transaction,.. not 1M, 100K or even 10K… it is 100!). A larger point is that for new-age enterprises like Airbnb, Lyft, Uber, DoorDash, etc. which count their customers/merchants in millions, none of the existing CRMs (and even CPQ/Billing/ERP systems) will work, and from what I have been told each is working on their own version of these systems. In fact, this opens a very interesting startup opportunity to build massively scalable, user-friendly, cloud-based CRM, etc. systems that can be used by next-gen enterprises. Even better, why not build a generic infrastructure enterprise IT layer that can run on top of any public cloud on top of which apps like CRM, CPQ, Billing, ERP, etc. can be run. Now, enterprises don’t need to maintain a separate CRM/ERP or even HR IT stack… all enterprise resources (whether people or assets) are represented in this one single stack which will make the job of IT hugely simplified as no data transformations would be needed). More on this in a later post.

2. Guided selling is limited to manual Q&A rather than context-driven (customer, country, vertical) or prior purchase history. Generative AI can be massive here.

3. Consumer concepts of UX and mobile-centricity were largely ignored.

4. Almost all existing CPQ/Subscription Billing vendors took a mid-market approach early on (startups often do that to score early wins). Here’s the disastrous side-effect though — enterprise use cases are not accounted for in these designs resulting in extremely inflexible systems with poor scalability, dysfunctional APIs, broken reporting, etc. This is one consistent feedback I heard across all vendors — they are not “enterprise-ready”.

5. Existing products were created more than 10 years back (even Zuora is 11 years old) and most if not all, seem to be running on outdated software architecture. Artifacts of the old architecture are — lack of scaling/performance, weak APIs, poor support for data extraction, restriction on programming language support, and underlying systems that don’t scale (Salesforce and since practically all CPQ systems run on force.com platform they inherit the same limitations). Several companies mentioned that the cost of a Salesforce sandbox environment is very pricey.

In my interviews, consistent feedback was that Quote-to-cash products need to provide 60–70% of the expected functionality out-of-the-box while the rest (customization) will be done by customers themselves as long as it can be done easily which seems to be not possible by current tools.

Fixing these issues cannot be done using a bolt-on fix-it approach. Re-architecting the core engine is essentially creating a new product. Instead, it requires a thought-through first-principles-based software design from day one.

Okay, but still existing vendors must be doing something. What’s that?

Either adding bolt-on products or doing acquisitions — Apttus did CPQ first, Billing later. Zuora did Billing first, and CPQ later. SAP acquired Billing first then CPQ (CallidusCloud, $2.4B, Jan 2018). Salesforce acquired CPQ (Steelbrick, $360M, Dec 2015) which in turn had acquired a billing vendor earlier.

All of these approaches are not working as acquisition merely puts the different tools under one vendor — however, the core issue of disparate product catalogs across these tools still remains.

The multiple-product approach (whether in-house or through acquisition) introduces immense bottlenecks in data flow requiring painful data translations resulting in brittle connections & never-ending maintenance.

How are enterprises dealing with this now?

They are forced to do either of the following:

- Buy existing products and hire an army of System Integrators to somehow make the products work together by undertaking complex integrations — roughly 10–20% of such implementations simply fail, and others that succeed end up creating brittle connections so that change management is a huge pain (both time & $$$) and agility is completely lost. One company spent $300M (!) on the CPQ transformation project with a less than satisfactory outcome. The general average tends to be in 10s of millions of dollars (this includes license cost, implementation cost, and ongoing maintenance).

- Build own tools — Everyone from large to medium enterprises knows that it is not a long-term strategy — creating and maintaining systems like CPQ/Billing is a complex undertaking and early benefits are quickly overtaken by long-term maintenance costs, lack of product direction, budget cuts, etc.). In my conversations, I came across 4 companies that have undertaken those efforts, and all of them (except one where it was the CTO’s idea) were forced to do it — their point was if they will have to spend huge money on SIs anyway, why not pour that money in internal development and control their own fate. However, these projects start with fanfare with an initial exec sponsor but in all cases except 1, they are failed or challenging undertakings. One company had a team of 300-odd engineers working on it, another had 80, and another had 50.

What’s the fix?

After having several of these conversations, some patterns started emerging and here are my thoughts on a product/system that I think can potentially solve the problems:

- First and foremost, the Pricing engine, Product catalog & Subscriptions need to be in ONE SYSTEM. The traditional way of putting Pricing and Catalog in CPQ and Billing in ERP separately worked well for one-time orders. With subscriptions, “order” is not a terminal entity, instead it lives on with amendments. The best way to handle that is by combining subscription handling (quoting, billing, amendments, renewals), product catalog, and pricing in one system.

- Second, think Enterprise-architecture Day 1. That means building a platform vs an application. Make data in/out extremely easy, provide home-grown rock-solid connectors to popular CRM/ERP solutions, focus on UX, easy extensibility, mobile-centric, run on the independent cloud instead of force.com (limits scalability, performance, even AI options).

- Third, cater to self-serve — future of enterprise selling: Provide an Amazon/Atlassian-like buying experience to other enterprises whose customers are increasingly smart buyers. This will unlock new and previously untapped revenue opportunities for enterprises and could be a real game changer. According to Forrester, 74% of B2B buyers prefer to buy online vs through channels. PLG is the name of the game and even if you are a sales-led enterprise, providing self-serve upgrades and renewals is a huge plus.

- Fourth, put data science / ML to good use. Q2C workflow sees financial / customer/machine data — the perfect place to apply ML driving up-sells, cross-sells, and renewals. e.g., “60% of customers like you bought this”. Also, how about tying product usage directly to customer portal to drive auto-upsell notification — “You are ready for an upgrade.”

- Fifth, rethink customer success: How about tying revenue to a successful implementation instead of just the initial sale. It may seem like a risky approach, but given that Q2C drives customers’ revenue/profitability if a lot of value is created for the customer, it will be a huge win-win proposition and a ton of money can be made to the extent that’s never been seen before in enterprise software.

Enter… Enterprise Monetization Platform

Benefit

- No need to buy & manage separate Billing and CPQ products (Do Subscription quoting, billing, usage, renewals, and amendments in ONE Platform).

- Usage-based Billing — send usage directly from your product to this platform. It will meter in real-time and generate an invoice that combines subscriptions and one-time products (billed in advance) and usage (billed in arrears) in one invoice. Furthermore, your product can query this platform and provide real-time usage info including prior invoices from “within” your product.

- True self-serve — imagine allowing customers to do amendments and renewals automatically with standard discounts. The buyer of today (including B2B) is looking for convenience and agility. They don’t want to wait to talk to a rep or customer success to do any changes.

- CPQ interface (web + mobile) that sales will LOVE to use. CPQ product's primary purpose is to help sales folks close deals as fast as possible but most, if not all, CPQ solutions just automate the selling process without making it easier/smarter. (I am reminded of the book “Don’t make me think” by Steve Krug).

- Provision new sales bundles in a matter of hours not weeks

- Ability to create dynamic bundles (finally no SKU proliferation!)

- Combine hardware and software in one quote

- Subscription amendments are so easy that they can be self-served as well!

- Go live in < 1 month (post requirements gathering)

Summary

Classic ERP and CRM systems that were designed decades ago around concepts of one-time order, rigid catalogs, inflexible pricing, direct/channel sales only (not self-serve) and closed systems are increasingly becoming irrelevant for enterprises that are obsessed about being agile and customer-centric.

In short, existing CRM and ERP systems are failing systems of records, unimpressive systems of engagement & non-existing systems of intelligence.

There is a super massive opportunity around re-imagining & re-building these systems & deliver an experience and not just a tool.

Addendum

Best independent writing I found on this subject:

The Future of Quote-to-Cash (Q2C) and the Commerce Cloud: Top Ten Strategies for SaaS Companies by Anandan (AJ), 2016. (I even met AJ in person subsequently).

Analyst Reports

- Gartner MQ 2018 for CPQ (provide info to download free copy from CloudSense)

- Forrester Wave CPQ Q1 2017 (provide info to download free copy from Apttus)

Market

CPQ/ Billing is part of overall $42.14B CERM (Customer Experience & Relationship Management) market. Source: Gartner.

CPQ Market: $1.2B (est. 2018). CAGR 20% through 2020.

Subscription Billing: $2.7B (est. 2018). CAGR 35% through 2022.

I think the market is much bigger since penetration of professional CPQ/Billing solutions is low (vs home grown or point solutions). One proxy for this data is # of customers for CPQ vendors (these are all in Gartner MQ)

Apttus — 300, Oracle BigMachines — 500, FPX — 62, Accenture — 25, Vendavo — 60

If we were to extrapolate the numbers to lets 5x of above, we get 5000 customers. By comparison, Salesforce CRM is deployed in more than 150K organizations. Moreover, enterprise subscription market is very nascent at this stage and both markets will have a healthy double digit growth through next 5 years so that overall market opportunity is close to $10B.

M&A (by date)

- $1B-$2B estimated, Apttus majority stake by PE firm Thoma Bravo, Sep 2018

- $2.4B SAP acquired CallidusCloud (CPQ), Jan 2018

- $303M Salesforce acquired Steelbrick (CPQ), Dec 2015

- $400M Oracle acquired BigMachines (CPQ), 2013